How People Know Their Risk Preferences

Center for Adaptive Rationality & Max Planck Fellow

Previous work found that laboratory lotteries used to reveal people’s risk preferences are less stable and predictive of real-world risk taking than survey-based stated preferences. How can stated preferences, often criticized as “cheap talk,” be so informative? Together with Max Planck Fellow Gert G. Wagner, researchers from the Center for Adaptive Rationality have investigated this question in a study published in Scientific Reports.

People’s willingness to take risks is a key factor in many decisions they make about their health, finances, and careers. Risk preferences have been widely investigated under two distinct measurement traditions. The first one is the revealed-preference approach, common in economics. Two hundred years ago, it began with observational studies of real behaviors (e.g., consumptive and saving behaviors) which can be used—based on strong assumptions—to infer preferences from people’s behaviors. However, this approach cannot control for the countless different circumstances in the real world and therefore only permits very general conclusions such as that most people behave in a risk-averse manner. In order to control for the impact of context and situation, incentivized laboratory experiments, where participants make choices between monetary lotteries became popular. These experiments are not affected by unknown circumstances and so the choice behavior in the experiments allows researchers to draw quantitative conclusions about underlying (“revealed”) preferences. At the same time, many psychologists, as well as some economists, have used an alternative method: a stated-preference approach in which people are simply asked to state their willingness to take risks.

The validity of stated preferences has often been called into question, particularly when respondents perceive a benefit in self-serving answers. Ironically, previous work found that the behavioral measures used in the revealed-preference approach generally underperform relative to the stated-preference measures in terms of convergent validity, temporal stability, and predictive validity. For instance, whereas revealed preferences in experiments do not correlate strongly across measures, meaning that they did not capture a clear latent preference that drives behavior, the stated risk preferences correlated across measures and suggest the existence of a general risk factor.

How can stated preferences, often criticized as “cheap talk,” be more valid and predictive than controlled, incentivized experiments? To better understand this question, psychologists Ralph Hertwig and Ruben C. Arslan (former research scientist at the Center for Adaptive Rationality), together with Gert G. Wagner, economist and Max Planck Fellow at the Institute, examined the cognitive processes behind stated preferences. The authors analyzed stated risk preferences collected as part of two large studies in Germany: the Berlin Aging Study II (BASE-II) and the German Socio-Economic Panel Innovation Sample (SOEP-IS; Box 1). These analyses were enabled by the theoretical and methodological expertise of the psychologists from the Center for Adaptive Rationality, combined with Gert G. Wagner’s background in economics, his experience in directing the SOEP for 22 years, and his role in spearheading the inclusion of measures of personal traits in the SOEP. It is a role that was recognized by the Association for Psychological Science, which elected Wagner as a Fellow in 2022.

Box 1. The German Socio-economic Panel Innovation Sample and the Berlin Aging Study II

The German Socio-Economic Panel (SOEP) is a representative multi-cohort study of private households in Germany. Individuals in households are interviewed about topics such as personal and political attitudes, income, employment history, education, personality, and health. In 2011, the SOEP established an innovation sample (SOEP-IS) to explore particularly innovative research questions.

The Berlin Aging Study II (BASE-II) is an extension and expansion of the longitudinal Berlin Aging Study (BASE). Developed by the Center for Lifespan Psychology together with Max Planck Fellow Gert G. Wagner and others, it was designed to investigate age-related changes in physical health, cognitive performance, and psychosocial dimensions among a convenience sample of younger and older adults. For more information see BASE-II.

Drawing on the literature on self-perception, the authors investigated how people infer their own risk preference by reflecting on their own behaviors and experiences, thus rendering their stated preferences informative. To this end, SOEP and BASE-II participants first answered a general risk question—a widely used measure of stated risk preferences that is predictive of real-world risk taking. Next, participants explained how they answered that first question by answering a series of follow-up questions. All questions are presented in Box 2.

Box 2. Stated preference measures

General risk question:

How do you see yourself: Are you generally a person who is fully prepared to take risks or do you try to avoid taking risks?

(Answered on a scale of 0 = unwilling to take risks to 10 = fully prepared to take risks)

Question about social reference frame (multiple choice):

What events, behavior, or people did you think about when you indicated a number for your risk preference?

Answer options: own experiences; own behavior; my behavior compared to others; the consequences of my behavior for me; the consequences of my behavior for others; and what people around me say about my risk preference.

In the SOEP-IS, three additional nonresponse options were used (see Figure 1).

Free-text questions:

What concrete experiences or behaviors—yours or others’—did you think about?

In what situations in the last 12 months were you prepared to take risks?

And were the risks worth it?

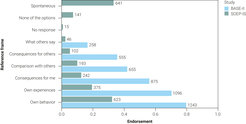

Figure 1. The Berlin Aging Study II (BASE-II) participants endorsed more options than did the German Socio-economic Panel Innovation Sample (SOEP-IS) respondents and did not have the option to say they responded spontaneously or based on something else. The options that were common to both studies were similar in rank.

Adapted from Arslan et al. (2020)

Original image licensed under CC-BY 4.0

In preparation for the data analysis, participants’ free-text responses were coded for the presence of risk domains, such as investments or health, as well as more specific hazards, such as cycling or divorce. Next, the coded hazards were presented to an online sample of different respondents who rated those hazards on several characteristics, including voluntariness, newness, and immediacy of consequences.

The results showed that when thinking about their risk preferences, respondents focused on risks that were familiar, that they took voluntarily, that had consequences known to those exposed, and that they could control and prevent. Furthermore, respondents focused on episodic health risks such as surgery and other interventions with immediate consequences and referred less to risks that have cumulative and delayed effects, such as smoking. Most respondents mentioned risks they took—say, whether to marry, divorce, move, quit a job, or study a particular field—and only a minority mentioned risks they avoided. Respondents almost never mentioned hazards that were dreadful, such as nuclear war. Among BASE-II participants who indicated having taken a risk in the previous year, the majority reported that taking the risk had been worthwhile.

The authors further examined the social reference frame people used, using a multiple-choice question (Box 2). Most respondents stated that they thought of their own experiences and behavior or the consequences of their actions; a substantial minority also mentioned comparison with others or what others say (Figure 1). The authors also found that the risks people invoked in their explanations differed by age and gender. On average, men were more likely to mention risks of injury such as sports risks. Women mentioned relationship and travel risks more often, and career risks less often, than men did. Older people—women and men alike—rarely mentioned career and education or sports but increasingly mentioned traffic, health, and safety risks. Young men were more likely to mention gambling; otherwise age trends were largely parallel for men and women.

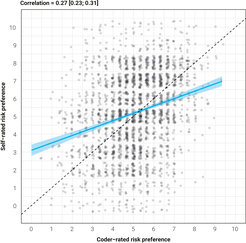

Another insight from the study is that the coders, third-party readers of respondents’ brief memories and explanations, could—solely on the basis of participants’ texts—estimate the stated risk preference of a text’s author (Figure 2). The coders—all between 23 and 36 years old—were even equally accurate when inferring the preferences of older respondents and those of the opposite gender. The correspondence between coder ratings and stated preferences highlights the validity of self-perception in shaping stated preferences. People’s brief memories and explanations of their experiences do provide diagnostic cues for inferring their risk preferences. Finally, the authors also found that the coders agreed not only with the respondents but also with one another, indicating that people's explanations of their experiences contain valuable information about their risk preferences and that these preferences can be reliably inferred from these explanations.

Figure 2. Coder accuracy. The blue line shows a linear regression fit with the 95% confidence interval shaded. Along the dashed line, coder ratings and self-ratings matched. Points were jittered slightly to reduce overplotting.

Adapted from Arslan et al. (2020)

Original image licensed under CC BY 4.0

Far from “cheap talk,” stated risk preferences are based on informative and diagnostic cues that enable intersubjective agreement about how people’s experiences reveal their preferences. The process of self-perception, in which people infer their risk preferences from their remembered experiences, enables otherwise unobservable risk preference to reveal itself to researchers. Ironically, the revealed-preference approach appears to have found new significance in research on stated risk preferences.

Research Project in Brief

Topic: How people know their risk preferences

Researchers: Ruben C. Arslan (Research Scientist, Center for Adaptive Rationality/Max Planck Fellow), Ralph Hertwig (Director, Center for Adaptive Rationality), Gert G. Wagner (Max Planck Fellow)

Period: 2018–2020

Funding: Max Planck Society

References